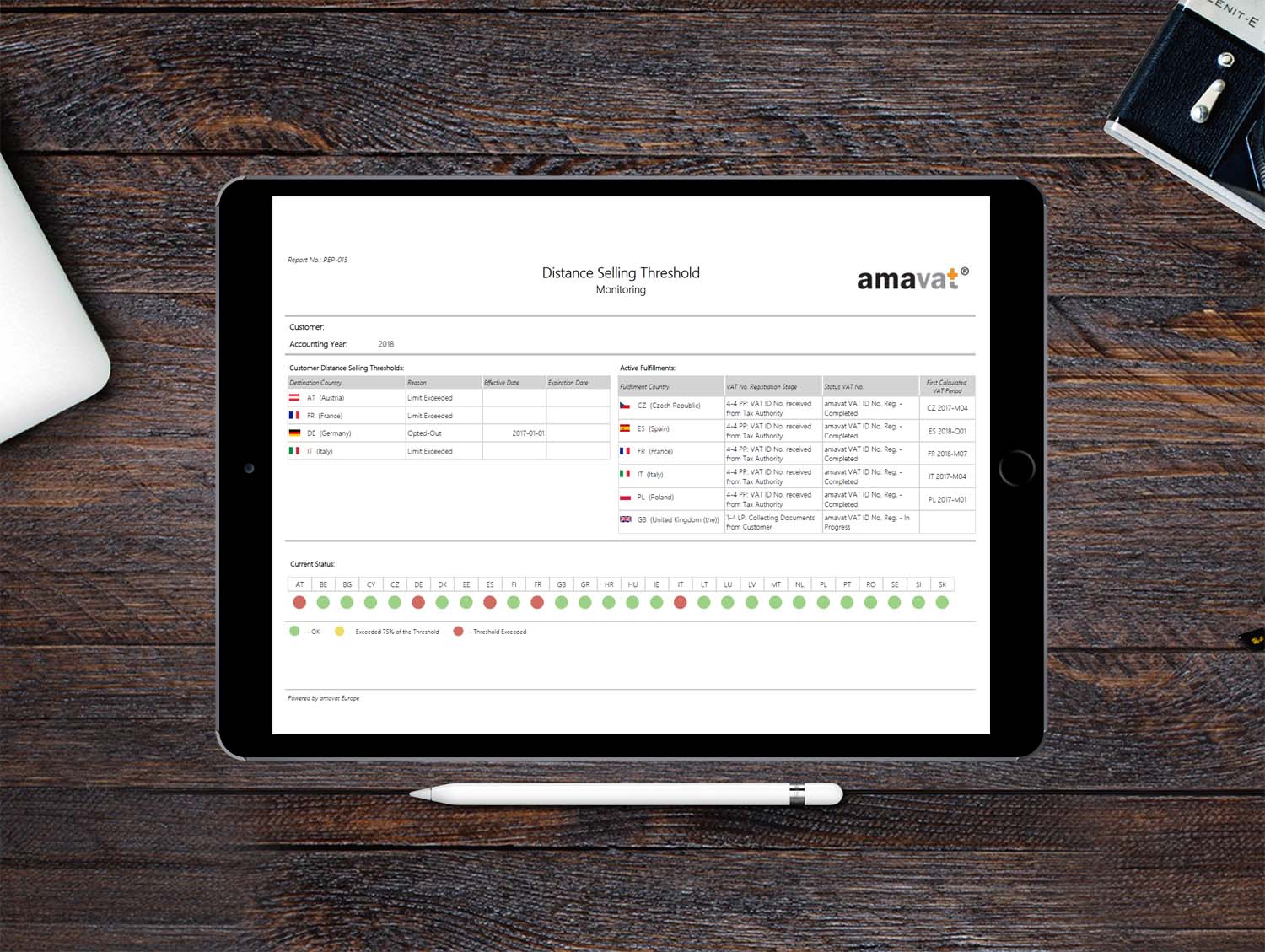

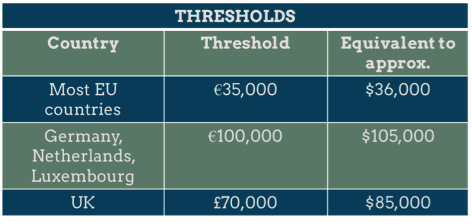

VAT on distance selling from another member state to France: new threshold in France: 35 000 Euros - ECOVIS International

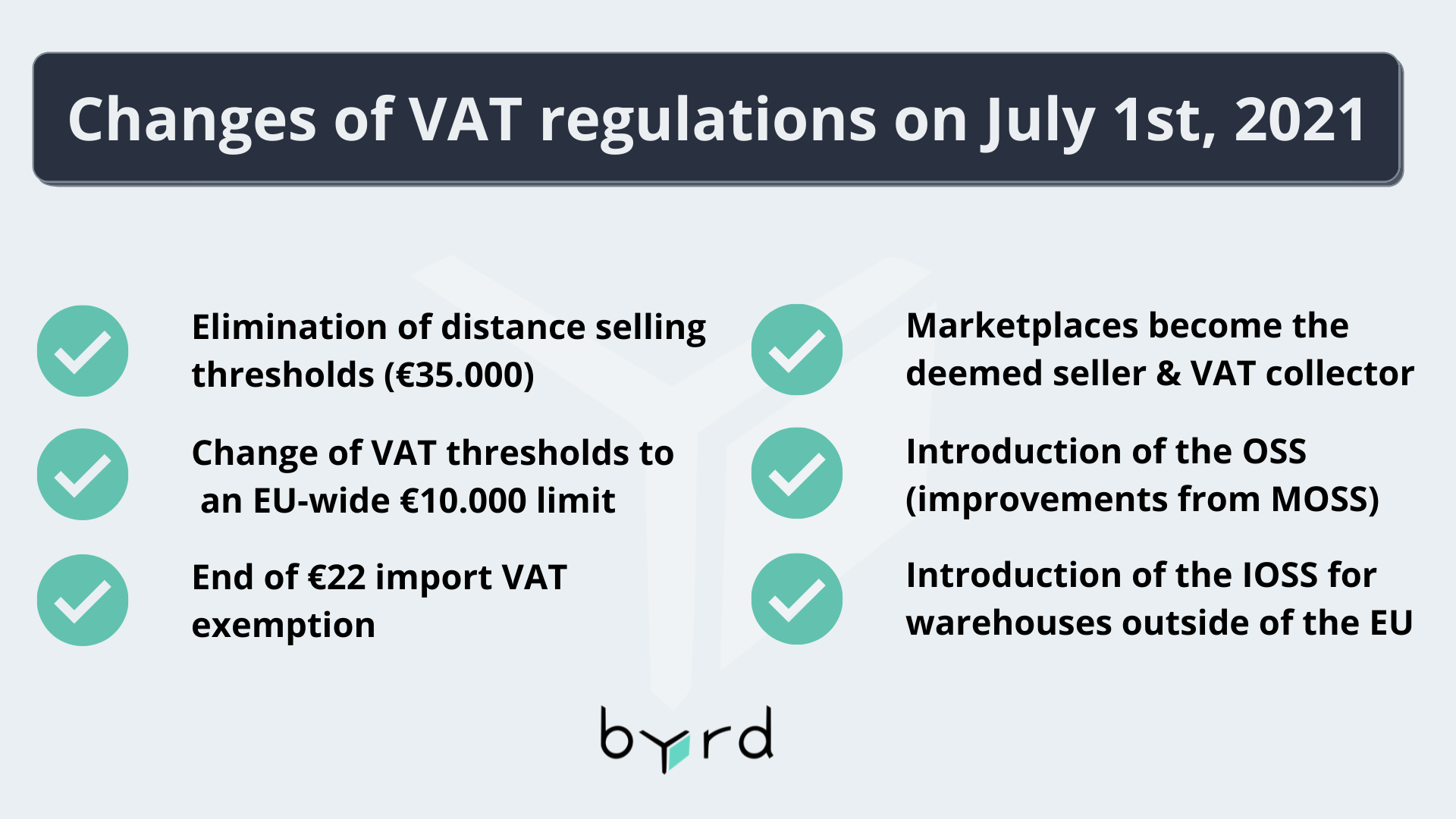

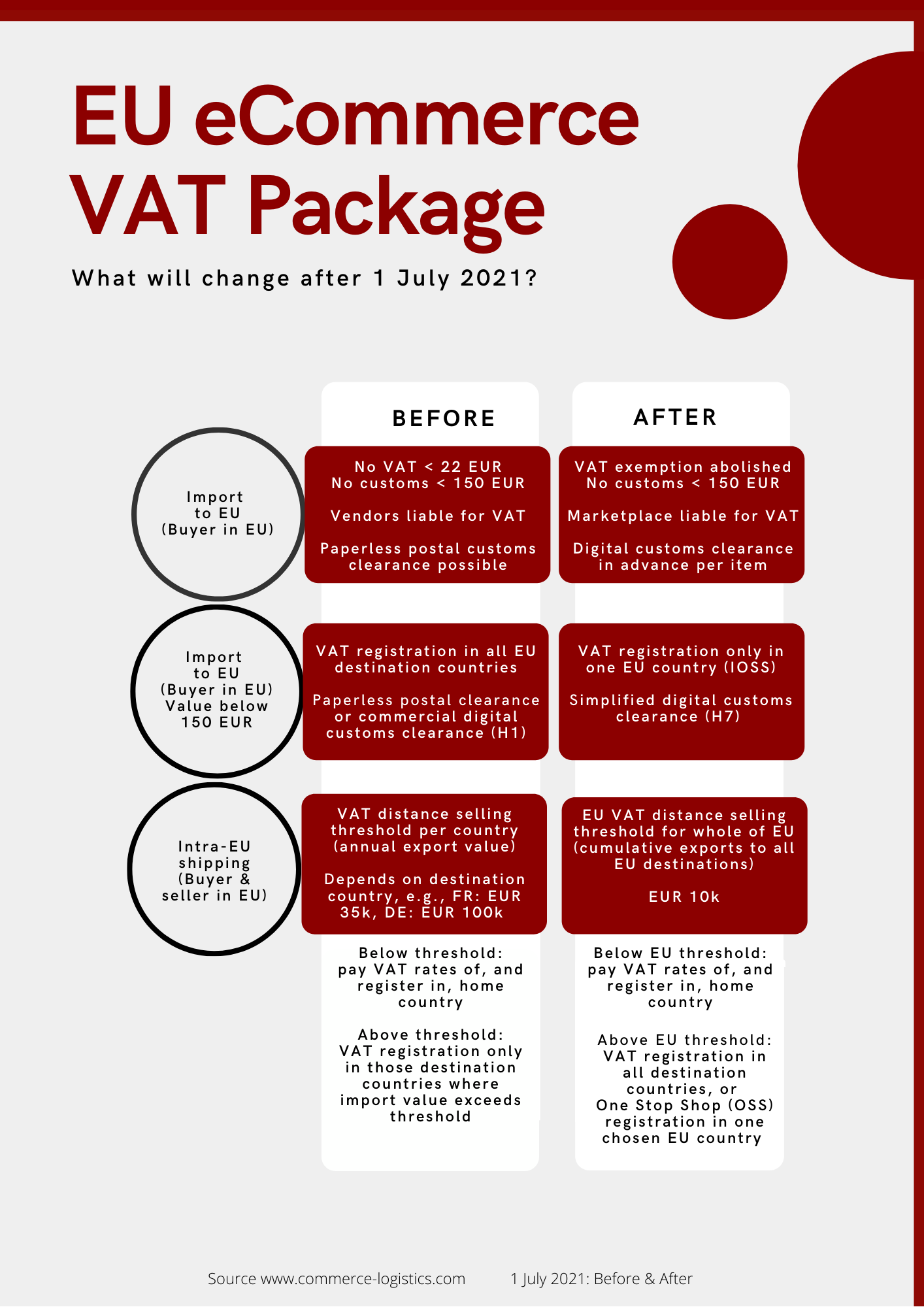

Goodbye distance selling thresholds - Hello OSS: What will change for almost all European online merchants as of July 1st - E-commerce Germany News

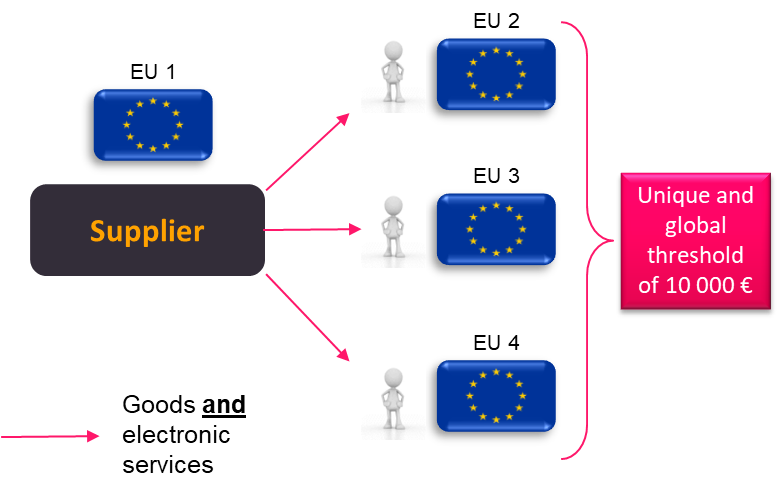

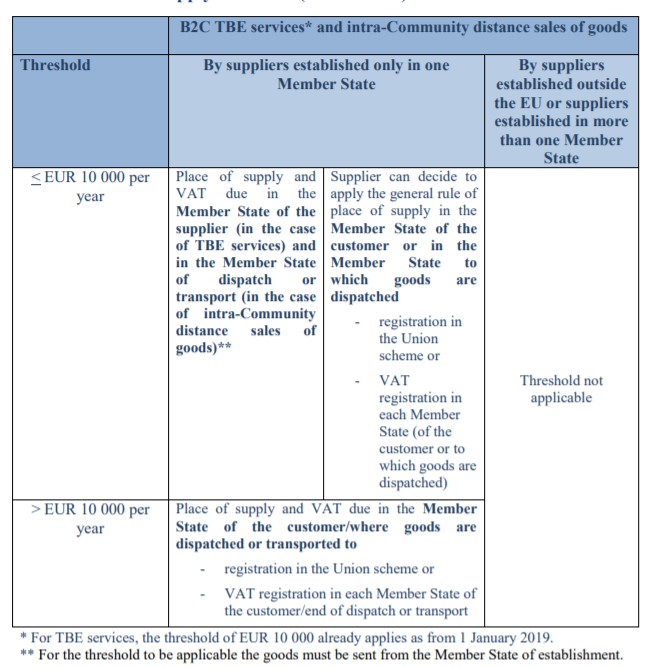

Demistifying new E-Commerce VAT rules in the EU – A threshold is still applicable for EU micro businesses .... - VATupdate

VAT compliance for online sellers in the EU: key risks and solutions - Dr. Moritz Lukas (Taxdoo) | PPT

Goodbye distance selling thresholds - Hello OSS: What will change for almost all European online merchants as of July 1st - E-commerce Germany News