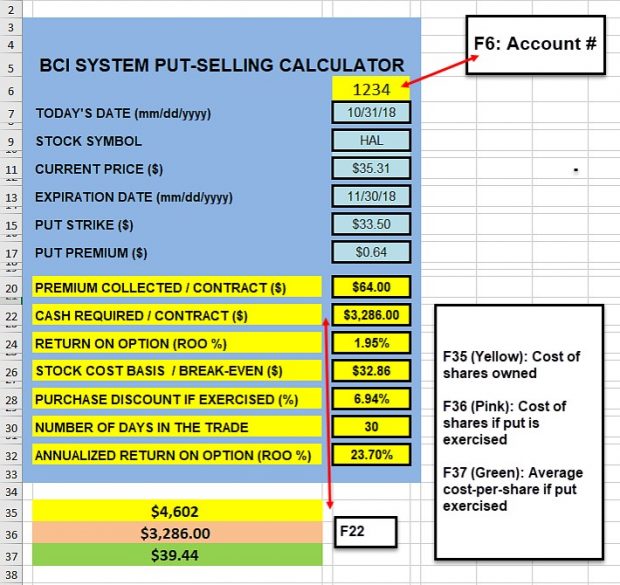

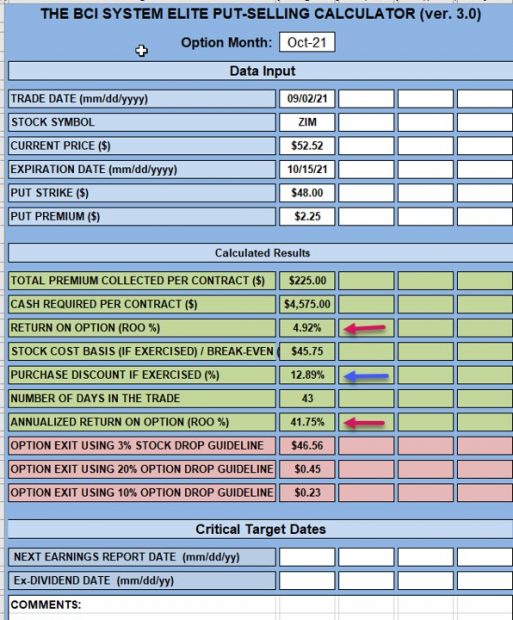

Generating a 3-Income Stream Put Trade: A Real-Life Example with ZIM Integrated Shipping Services Ltd. (NYSE: ZIM)The Blue Collar Investor

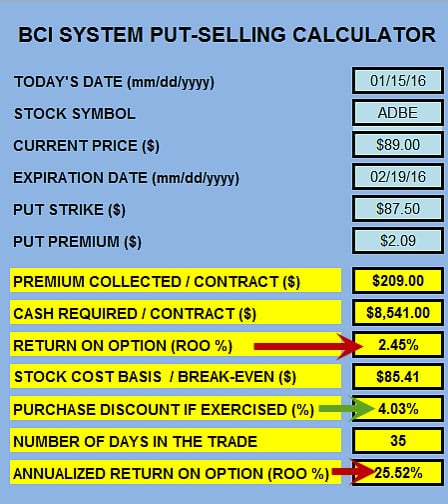

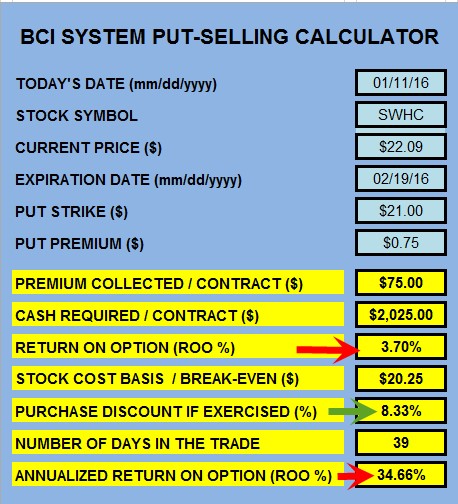

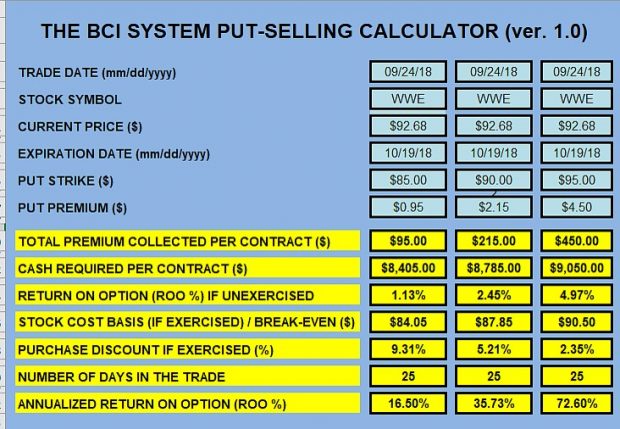

Strike Price Selection When Selling Cash-Secured Puts: A Real-Life Example with WWEThe Blue Collar Investor

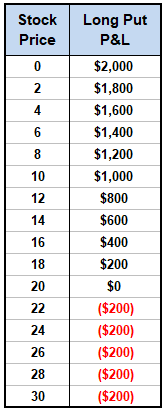

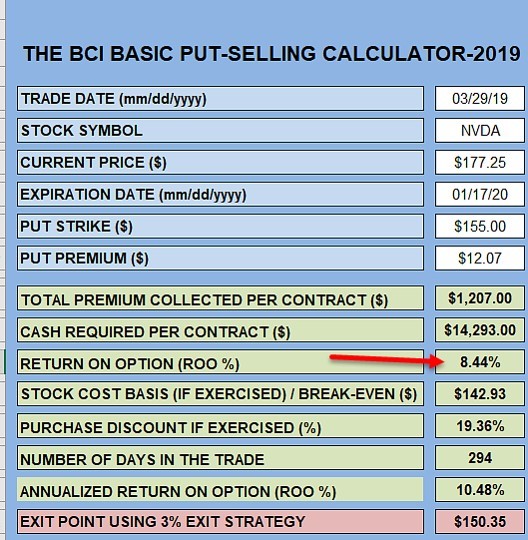

Using Puts and SelectSector SPDRs to Create an Ultra-Conservative Option- Selling StrategyThe Blue Collar Investor

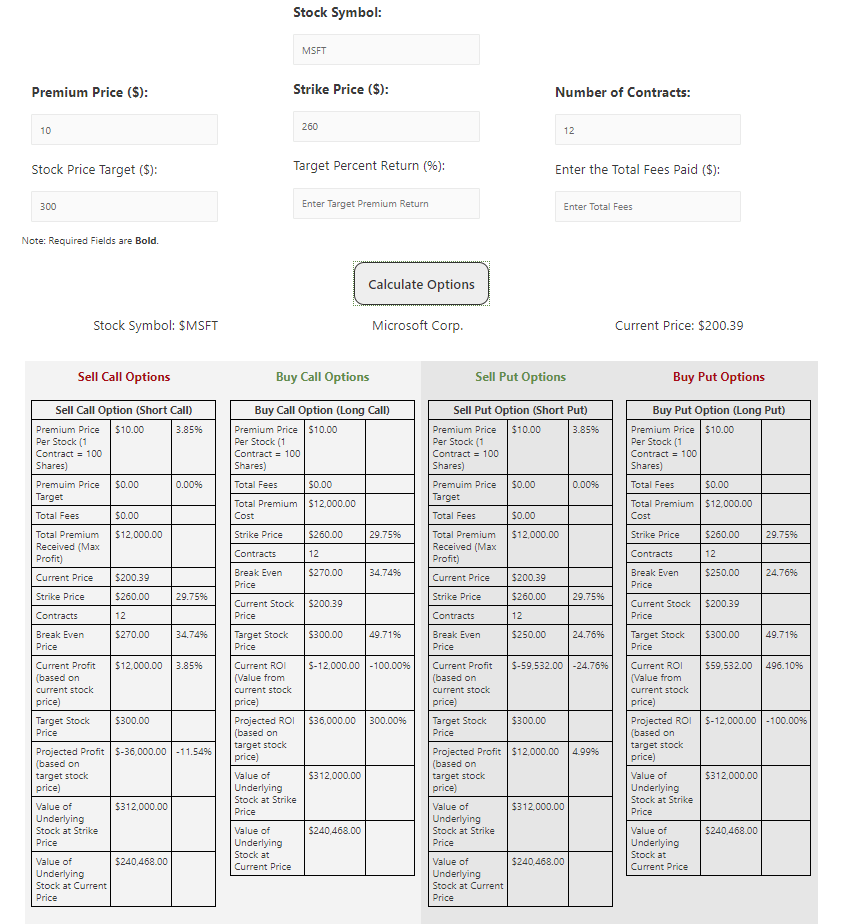

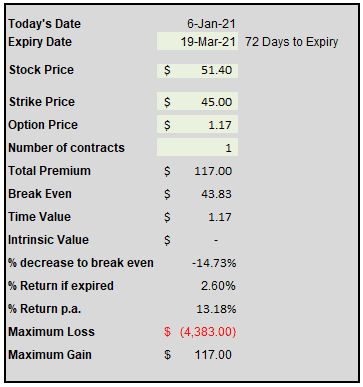

Options Calculator Bundle / Wheel Covered Calls Put Selling / Google Sheets Spreadsheet / Template - Etsy Ireland

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)